Trust in simple,

fair and transparent pricing.

Ready to get started? Start your 14-day free trial today!

Calculate your monthly pricing

To pay:

—Employee(s)

On a:

—Basis

- Frequency

- Weekly (once a week)

- Bi-weekly (every two weeks)

- Semi-monthly (twice a month)

- Monthly (once a month)

Cost per month:

$ —

Solo

Best for businesses that only run one payroll per month.

$20/month

Plus $4 per employee/contractor

Plan details:

- Direct deposit

- Tax remittances

- Year-end reporting

- Records of employment

- Employee self-onboarding

- One paygroup

- One payroll per month

Unlimited

All-you-can-payroll. Best for businesses handling multiple payrolls in a month.

$40/month

Plus $6 per employee/contractor

Plan details:

- Direct deposit

- Tax remittances

- Year-end reporting

- Records of employment

- Employee self-onboarding

- Multiple paygroups

- Unlimited payrolls per month (including off-cycles)

Unlimited

All-you-can-payroll. Best for businesses handling multiple payrolls in a month.

Plus $6 per employee/contractor

Plan details:

- Direct deposit

- Tax remittances

- Year-end reporting

- Records of employment

- Employee self onboarding

- Multiple paygroups

- Unlimited payrolls per month (including off-cycles)

Solo

Best for businesses that only run one payroll per month.

Plus $4 per employee/contractor

Plan details:

- Direct deposit

- Tax remittances

- Year-end reporting

- Records of employment

- Employee self-onboarding

- One paygroup

- One payroll per month

Compare our plans

Solo

$20/mo

Unlimited

$40/mo

Plus $6 per employee/contractor

Solo

Plus $4 per employee/contractor

Unlimited

Remittance and reporting capabilities within Wagepoint vary by location. Authorization to submit ROEs is required during setup.

Plan for year-end from day one.

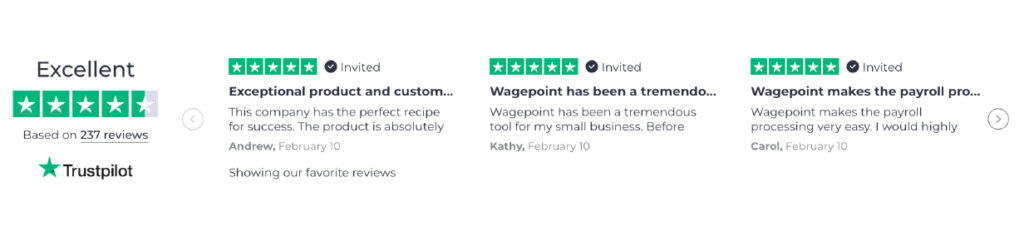

Trust Pilot section

Wagepoint FAQs

Got questions? We have answers.

The pricing on this page applies only to our payroll software. If you add People by Wagepoint, additional costs will apply.

You will receive monthly invoices on the last day of your billing period.

Example: If you start your 14-day free trial on the 1st and want to move forward with Wagepoint after your trial is over, your monthly subscription will start on the 15th and you will be invoiced on the 15th of the following month.

Yes, at this time we only serve small businesses in Canada. If, over time, we are able to expand to other countries, you can be sure we’ll let the world know. Or, at the very least, we’ll update our website!